Mainstreaming Gender in Tax Administrations

On 27 April 2023, the Network of Tax Organisations (NTO) hosted a webinar on “Mainstreaming Gender in Tax Administrations”. The webinar featured presentations and perspectives from representatives from the Foreign, Commonwealth and Development Office (FCDO) Pakistan, the Zambia Revenue Authority (ZRA), and the African Tax Administration Forum (ATAF). The presentations provided insights on how to address gender inequality in the field of taxation with a particular focus on tax administrations. Ms Berni Smith from HM Revenue and Customs (HMRC) and the FCDO moderated the session.

Tax systems have significant implications for gender equality and, hence, require intentional consideration and adaptation on the part of policymakers. This is particularly pressing in the post-COVID world in which many underlying gender inequities have been exacerbated. When dealing with the interaction between taxation and gender, for example, it is imperative for governments to address both the explicit impacts of tax systems on gender equality – which are caused by intentional policy design – as well as implicit gender biases. The latter arise from the interaction of tax systems with existing “gendered patterns of social arrangement, gender pay gaps, and other economic behaviour” that create a favourable outcome for men. The international effort directed at mainstreaming gender aspects in the design and enforcement of tax policy also requires the active engagement of tax administrations: that is including but not limited to the topic of gender disaggregated data collection, empowering women to take leadership roles, and improving the experience of women taxpayers.

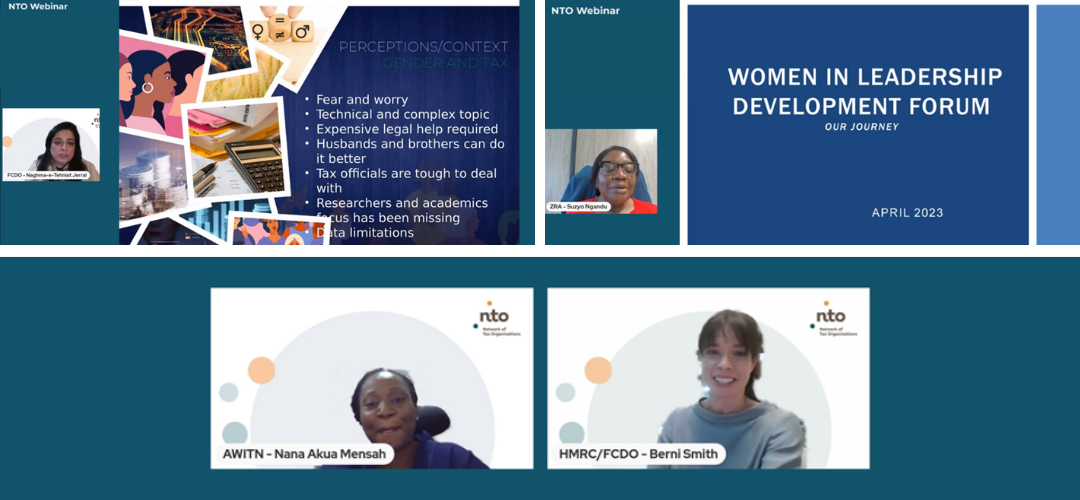

Laying the foundation for the NTO webinar on “Mainstreaming Gender in Tax Administrations”, Ms Smith (HMRC/FCDO) opened the event with a short input on the topic of tax and gender followed by two polls directed at participants to assess the knowledge and the interest on the topic. The first poll enquired about the percentage of women holding leadership positions in their respective revenue administrations. Most of the participants indicated the proportion of women working in leadership positions to be in the range of 51-80%. The second poll focused on the participants’ preferred mode of exchange for the engagement with other tax administrations on the topic of tax and gender. A large proportion of poll participants indicated peer learning as their preferred format.

Ms Naghma-e-Tehniat Jerral, from the FCDO – Pakistan, presented the Revenue Mobilisation, Investment, and Trade (REMIT) programme in Pakistan. It is the first of its kind regarding gender reforms and the use of taxes to promote gender equality in the country. On the topic of tax enforcement and compliance, one main challenge faced by the country was the tax perception of women. According to this, taxes are perceived as a complex matter which require expensive legal services or the help of their male entourage to be able to comply with the regulations. As a response, REMIT provides trainings to alleviate this fear as well as to create a gender inclusive and enabling environment in tax collection.

The second speaker, Ms Suzyo Musukwa Ng’andu from the Zambia Revenue Authority (ZRA), presented the Women Leadership Development Forum (WLDF) which aims at promoting and empowering women to take up senior leadership positions in the ZRA. The goal of the WLDF is to ensure a gender balance in senior leadership positions – director level and above – by 2023. In order to achieve this goal, the WLDF has conducted workshops and trainings for ZRA women including workshops on communication skills, executive presence, and leadership strategies for small and medium-sized enterprises (SMEs). Furthermore, the WLDF is developing a mentorship programme for ZRA women.

Ms Nana Akua Achiaa Mensah from the African Tax Administration Forum (ATAF) spoke about the ATAF Women in Tax Network (AWITN) which is a unique platform that connects African women professionals working in the field of taxation. Beyond empowering women to engage in tax, it works towards pushing the discussion on the effect of tax policy on gender equality in African countries. Membership is open to African women within the field of taxation – including governmental and non-governmental institutions, academia, civil society as well as aspiring professionals with an active interest in tax. Ms Mensah highlighted that the platform provides possibilities to exchange, learn, network, and enhance knowledge in the area of taxation.

Following the presentations, the Q&A session enabled an insightful peer exchange among the speakers and the participants. Amongst others, it was highlighted that due to the technical nature of taxes and the demanding nature of the relevant trainings, many women are directed away from the area. Positions that presuppose frequent travelling and long working hours, for example in custom offices, could further drive them away.

Ms Smith closed the discussion by pointing out that (1) the accessibility of the tax system to women should be drawn to the attention of policymakers as a key step towards the integration of women in the labour markets of developing countries; (2) the integration of women in leadership positions is important to achieve social change and sustainable economic growth; and (3) it is important for women to form partnerships and platforms in order to push the topic of gender equality to the heart of the public debate, as social change requires a coordinated effort.

The Network of Tax Organisations (NTO) extends its appreciation to the speakers and the participants of this webinar. As a peer learning platform, the NTO will continue to bring together experts and stakeholders to discuss contemporary tax administration issues. The NTO Secretariat looks forward to welcoming further participants in its future activities.