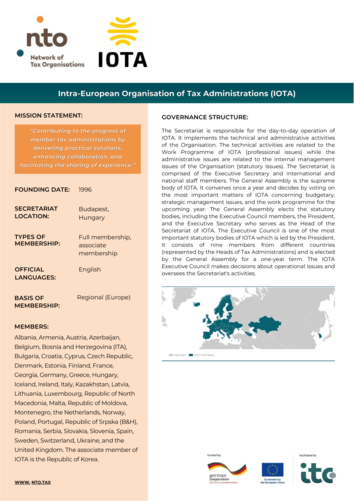

Intra-European Organisation of Tax Administrations

About

The Intra-European Organisation of Tax Administrators (IOTA) offers its members a platform for cooperation at the European level. Through IOTA, members have the opportunity to exchange information and good practices. Further, IOTA provides professional knowledge and expertise on practical tax administrative issues through technical Events (workshops, case study workshops, special interest workshops, hot topic workshops, forums, webinars, etc), its Annual International Conference, projects (conducted as part of the Forums’ mandates as well as sponsored by members), Technical Enquiries, Technical Assistance, Publications (Tax Tribune Magazine, IOTA Papers, IOTA Books, Reports, Guides, etc.). IOTA has 44 member states.

Objectives

- Improve effectiveness and efficiency of tax administrations

- Regional and international partnership and cooperation

- Forum for exchange

- Technical assistance

Activities

- Research

- Conferences

- Publications

- Seminars and workshops

Organisational Structure

IOTA Secretariat

Responsibilities

- Technical and administrative functions of the organisation

- Affairs entrusted by the General Assembly, the Executive Council and the President

General Assembly (annually)

Members

- Heads of the tax administrations of the member countries

Responsibilities

- Supreme decision-making body of IOTA

Executive Council

Members

- President, eight members

Responsibilities

- Managing and following up on the performance of activities

- Executing the budget supervising the Secretariat

Resources

- Annual membership contributions that are calculated on the basis of the average GDP of members in the last three years, whereby members are classified in eight groups

- Fees received from observers

- Voluntary contributions and donations

- Fees received from the provision of services